Self-Storage Portfolio, DST

ASSET CLASS: Self-Storage Portfolio

OFFERING SIZE: $18,227,000

MINIMUM INVESTMENT: $100,000

LEVERAGE: 40.49%

# OF PROPERTIES: 11

# OF STORAGE UNITS: 2,727

HOLD PERIOD: 7-10 Years

TARGETED YR.-1 RETURN: 6.00%

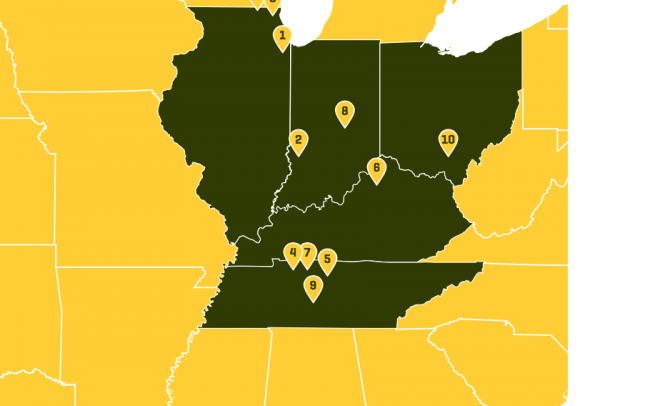

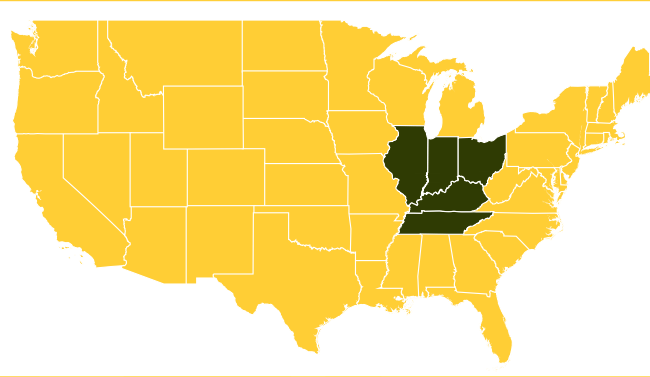

The Trust owns 11 self-storage facilities, which are operated under the Red Dot Storage brand. Four of the Properties are in Tennessee, three Properties are in Illinois, two Properties are in Indiana, one Property is in Kentucky, and one Property is in Ohio. The Properties comprise a total of 2,727 storage units that encompass 357,670 rentable square feet.

The Richton Park, Gurnee, and Antioch Properties are all considered part of the Chicago MSA. Located in southern Cook County, the Richton Park Property, is easily accessible via Interstate 57. Located in north central Lake County and in northern Lake County, the Gurnee and Antioch Properties are located between the Chicago and Milwaukee Central Business Districts and are accessible via Interstate 94.

With a population of approximately 9.6 million, the Chicago metropolitan area is the third most populous in the country. The Chicago MSA has a large and well-diversified economic structure, which has allowed it to remain among the strongest economic centers in the nation. Due to its economic diversification, the Chicago metropolitan area tends to experience fewer seasonal and cyclical peaks and valleys than do many single-industry areas.

The Greenbrier Property, located in Greenbrier, TN, is considered part of the greater Nashville, TN MSA. The Greenbrier property is located 30 minutes north of the Nashville Central Business District and is accessible via Interstate 65.

The Clarskville #1 and Clarksville #2 Properties are located in the Clarksville, TN-KY MSA, a suburb of the Nashville, MSA. Located 45 miles northwest of the Nashville Central Business District and 15 miles south of Fort Campbell, these properties are well positioned to serve both the Nashville MSA and the more than 200,000 people that reside and/or work at Fort Campbell.

The Columbia Property, located in Columbia, TN, is considered part of the greater Nashville, TN MSA. Columbia is 40 miles south of the Nashville Central Business District and is accessible via Interstate 65. Characterized as a bedroom community of Nashville, Columbia has experienced strong population growth as large employers, including General Motors, grow their presence in the Nashville area.

The Nashville metropolitan area has a population of three million and is expected to continue to grow by 1.5% over the next five years. Unemployment in Nashville is 3.6% and is expected to remain low as the area’s top three industries (Health Care, Manufacturing, and Retail Trade) continue to grow. We believe Nashville MSA’s strong economy is well positioned for growth over the next few years.

The Terre Haute Property is part of the Terre Haute MSA. Located 75 miles southwest of Indianapolis, Terre Haute is accessible via Interstate 70. The city of Terre Haute has experienced a steady increase in population growth since 2010. The primary industries in the MSA are manufacturing services and health care followed by education. Terre Haute is home to Indiana State University and the Rose Hulman Institute of Techonology, together the two have total enrollment of 16,000 students boding well for self-storage given the highly transient nature of the student body. The Terre Haute MSA is forecasted to experience an increase in population, household income, and household values over the next few years.

The Crestwood Property is part of the Louisville-Jefferson County, KY-IN MSA (the “Louisville MSA”). Located on the east side of the Louisville MSA, the Crestwood Property is 15 miles northeast of downtown Louisville and is accessible via Interstate 71. With a population of 1.3 million in the Louisville MSA, the area benefits from a strong presence of large employers in diverse industries, primarily automotive manufacturing, healthcare, and shipping. The area has a 4.5% unemployment rate and projects population growth of 1.0% and median household income growth of 13.4% over the next five years.

The New Palestine Property is part of the Indianapolis-Carmel-Anderson, IN MSA (the “Indianapolis MSA”). Located on the west side of New Palestine, 13 miles southeast of the Indianapolis Central Business District, the New Palestine Property is accessible via Interstate 465. With a population of over two million, the Indianapolis MSA benefits from a diverse employer base dominated by health care, manufacturing, and retail trade. Strong growth experienced by businesses including FedEx and Eli Lilly coupled with an unemployment rate of 3.7% positions the Indianapolis MSA for additional population growth and household income growth by as much as 17.7% over the next five years.

According to the 2019 Self-Storage Almanac, there are approximately 45,547 self-storage facilities in the nation totaling over 22.0 million units. In total, there are nearly 1.7 billion square feet of self-storage space, or approximately 5.4 rentable square feet of self-storage for every man, woman and child living in the U.S. The average self-storage property measures 37,523 square feet. In comparison to historical standards, today’s self-storage facilities are larger, however are equipped with a fewer number of storage units. This would indicate that developers are building a number of larger storage units within their projects and existing projects may be converting units to meet the demands of their customers.

Self-storage customers typically fall into one of four categories, namely, residential, business or commercial, military, and students. Residential is by far the greatest category of renter, with approximately 77% of all self-storage units occupied by residential renters. Although 68% of all residential renters live in a single-family home, a number of life changes including a relocation, change in family status, the birth or death of a family member, or a household remodeling project can attract them towards self-storage rental. In addition, many apartment or condominium renters do not have enough storage space where they live and are seeking a longer- term storage solution. Commercial tenants make up an increasingly larger portion of self-storage. At 19% of total units, most commercial tenants are small business owners or contractors who need to store equipment or inventory off-site. Military and defense spending and relocations continue to be a large driver of self-storage demand with 2.0% of total units leased to military personnel. Many military renters are enlisted servicemen and women who need a storage facility to house their belongings while away in training or on deployment. Finally, approximately 2.0% of the nation’s self-storage renters are students.

Targeted Yr.-1 Cash-on-Cash: 6.00%

Targeted Cash Range: 6.00% - 8.16%

Targeted Cash Average: 6.93%

Projected IRR: 9.20%

All-In Price: $30,627,000

Purchase Price: $26,830,000

Appraised Value: $27,115,000

Loan Amount: $12,400,000

Equity Raise: $18,227,000

Trust Reserves: $698,529

Reserves to All-In Price: 0.00%

Reserves to Equity: 0.00%

On-Going Reserves (Yrs. 1-10): $698,529

On-Going Reserves to All-In Price: 2.28%

On-Going Reserves to Equity: 3.83%

Net Load: $3,797,000

Net Load to Equity: 20.83%

Net Load to All-In Ratio: 12.40%

Appraised Net Load: $3,512,000

Appraised Net Load to Equity: 19.27%

Appraised Net Load to All-In Price: 11.47%

All-In $/Ft.: $125.35

All-In $/Unit.: $113,015

Net Operating Income: $1,784,195

Purchase Cap Rate: 6.65%

All-In Cap Rate: 5.82%

Breakeven Exit Cap: 8.25%

Breakeven Exit Cap Rate Spread: 160 bps

Appraised Cap: 6.58%

Appraised Cap Rate Spread: 167 bps

Loan Amount: $12,400,000

Term: 10 Years Fixed

Interest Only Period: 5 Years

Amortization Period: 30 Years

Interest Rate: 4.08%

Lender: LegacyTexas Bank

LTV: 40.49%

Non-Recourse: Yes to Investor

Call Today for More Information

(415) 336-9225DISCLAIMER

The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the confidential Private Placement Memorandum (the “PPM”) which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by the issuing company, or any affiliate, or partner there of the issuer. All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. With respect to the “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. Past performance and statements regarding current occupancy and earnings are no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by the issuer, or one of its partner/issuers. The issuer does not warrant the accuracy or completeness of the information contained herein. Some offerings are subject to a “cooling off” period and are not available to all investors. Thank you for your cooperation.

Securities offered through Emerson Equity LLC Member: FINRA/SIPC. Only available in states where Emerson Equity LLC is registered. Emerson Equity LLC, and the issuer are not affiliated.